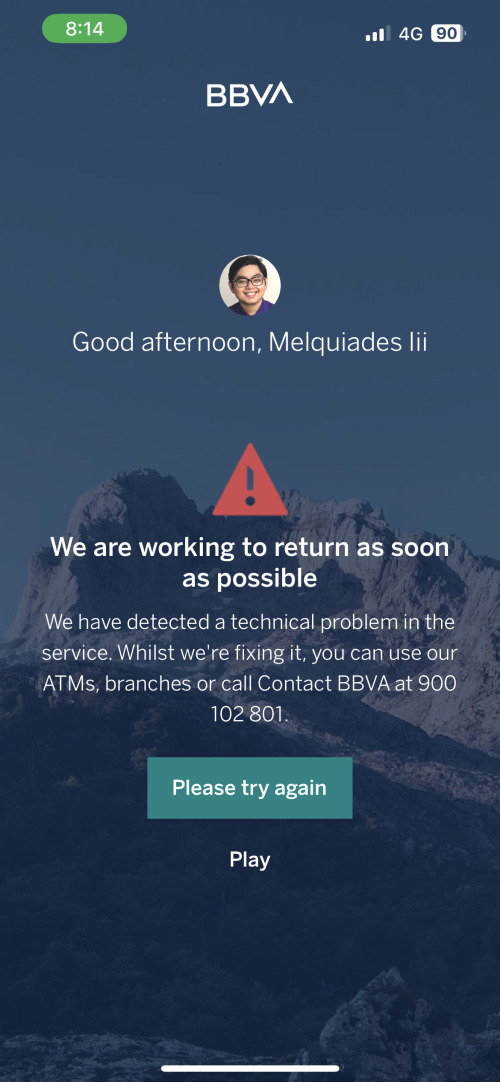

Yesterday, BBVA’s mobile app and website suffered a severe system issue which rendered it inaccessible for several hours.

Fortunately enough for me and my husband, we didn’t need to make any urgent transactions using their app, which suddenly had a “Play” button. This piqued our curiosity and we were amused to find that they had added a game that was similar to Chrome’s Dinosaur Game but with a bicycle instead of a dinosaur, and we wasted no time in entertaining ourselves with it.

According to UX Planet, Chrome's Dinosaur Game was meant to distract and/or entertain users who were having issues with their internet.

This got me thinking about their crisis response strategy in relation to clients such as myself, which I found beautiful in its simplicity.

- They informed clients through their app and social media, and creatively diverted expected frustration into a potentially positive experience by temporarily adding a simple game.

- I had never seen this on a mobile bank app before, and it was a refreshing experience.

- The novelty of the experience, coupled with a lack of any urgent transactions, turned the incident into a positive experience for me, and I was able to appreciate the subtle and playful way they managed the crisis - after all, these things do happen.

- Nonetheless, this could also be a double-edged sword, as unfortunate clients who urgently needed to transact using its mobile application still wouldn’t have been appeased because they were still deprived of the online service, which leads to my next point.

- They provided alternative ways of accessing their services.

- As a bank, they are expected to provide their depositors with uninterrupted access to their funds.

- During the service outage, they did this by pointing clients who have urgent transactions to alternative channels, such as ATMs and their bank branches (although only ATMs were effectively available because it was a Saturday).

BBVA’s Great Customer Service

All things considered, this single incident did not reflect the totality of BBVA’s service, as my experience of their service has been stellar so far, as listed below.

- Super easy to open an account

- It was a breeze opening a bank account with them.

- My husband and I were able to open a joint bank account online. We just got into a video call with a bank representative who verified our identities and our National IDs (i.e. DNI / TIE), and we were able to access our new joint account about an hour later.

- Awesome mobile app

- I love collecting receipts, and this was an important factor when my husband and I were looking for a bank which had a mobile app that allowed us to upload receipts for each expense that we made using our joint account.

- BBVA’s mobile app allows users to upload receipts for all transactions - including deposits.

- Reliable service

- Until yesterday, their mobile app service had been so consistent that I had never experienced any downtime at all.

- This might not be a big deal to some, but I come from a country where banks and their apps are plagued with issues.

- Competitive

- They work hard to promote customer loyalty. They don’t charge any commissions and there’s no maintaining balance for new clients - since my husband and I didn’t have accounts prior to opening our joint one with them, we were able to enjoy this perk.

- They regularly offer promos, where we each got €30 just for fulfilling some condition.

- Digital wallet support

- Their cards can be added to digital wallets such as Apple Pay. This seems like a common thing in Spain, but prior to moving here, I was not able to add my debit and credit cards to Apple Pay due to lack of support in the Philippines.

A final word on BBVA’s crisis response

While everyone in the tech industry dreams of providing 100% service availability 24/7, the reality is that service outages do happen. I would say that BBVA’s response to this unfortunate incident was simple, novel, and definitely memorable.